Depreciations

Depreciation in AssetIT is a way to account for the gradual decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors. It helps businesses track the asset's current worth and make informed decisions about replacements or disposal.

Depreciation rules are associated with asset models, with each rule being applicable to multiple asset models.

This guide is here to help you with setting up new depreciation rules and ensuring they are assigned to Asset Models for asset value tracking.

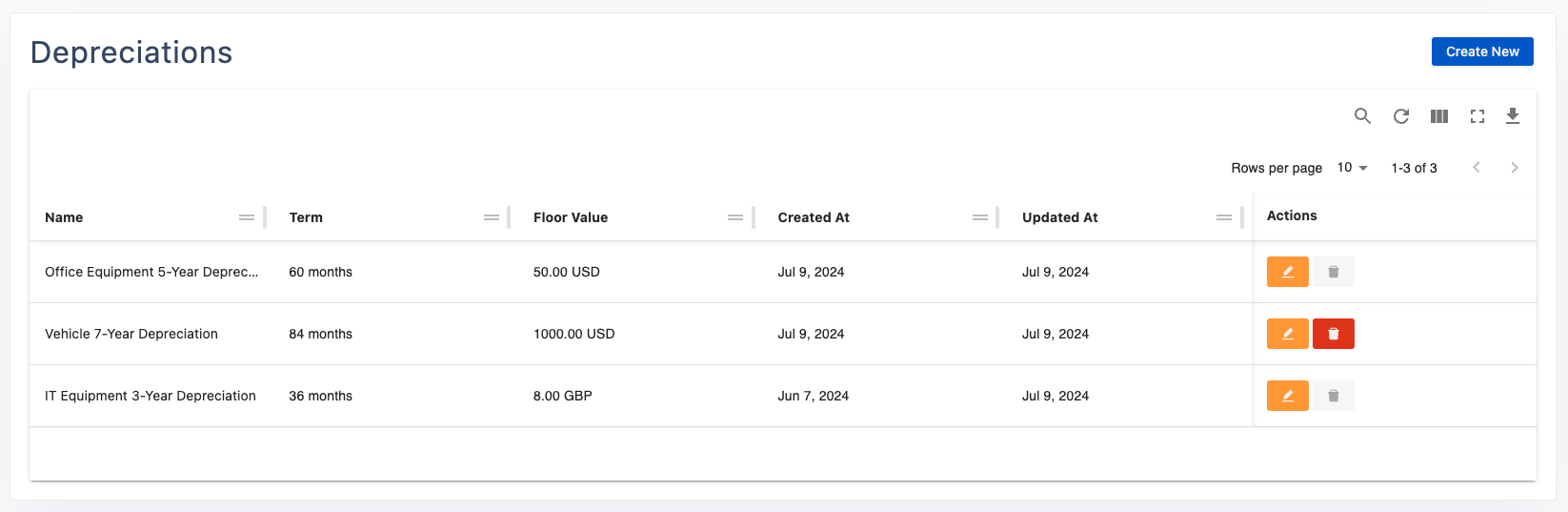

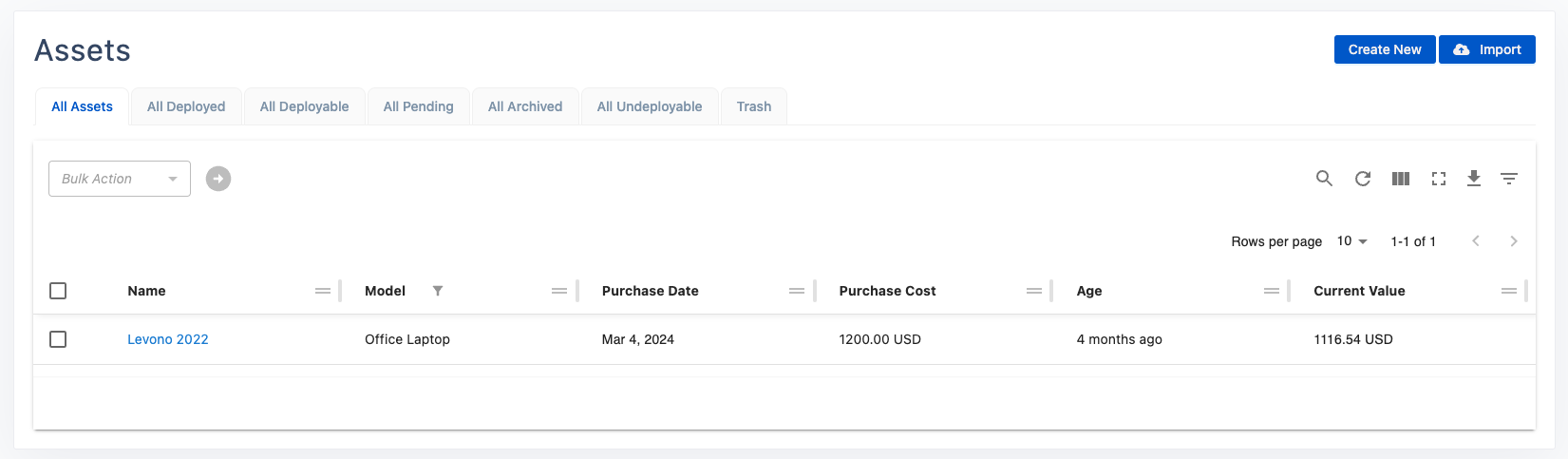

Depreciation List

You will find a list of created depreciation rules when you navigate to the Depreciations tab on the sidebar menu. This list comprises the following columns:

Name: The name of the depreciation rule.

Terms (No. of Months): The number of months over which the asset will be depreciated.

Floor Value (Minimum Value after Depreciation): The estimated minimum value the asset will retain after depreciation.

Created At/Updated At: Dates when the rule was created and last updated.

Actions: The option to edit or delete a rule.

You also have the option to search, export, or interact with columns by re-ordering, showing, hiding columns, and more.

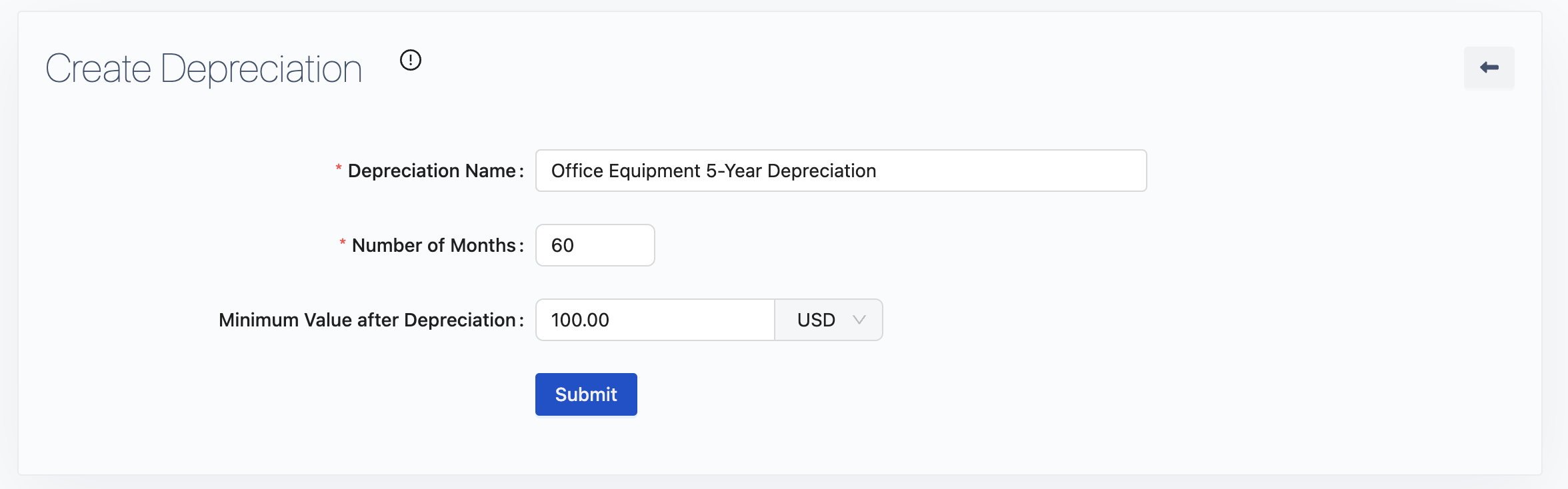

Creating a New Depreciation

To create a new depreciation rule in AssetIT, follow these steps:

Click on

on the top right of the Depreciation List page.

on the top right of the Depreciation List page.Fill in the fields of:

Depreciation Name: Enter a descriptive name for the depreciation rule. This helps in identifying the rule easily.

Example:

"Office Equipment 5-Year Depreciation"

"IT Equipment 3-Year Depreciation"

"Vehicle 7-Year Depreciation"

Number of Months: Specify the number of months over which the asset will be depreciated.

Example: "60 months" for a 5-year depreciation period.

Minimum Value after Depreciation: Enter the minimum value that the asset should retain after the depreciation period. This ensures that the asset's value does not drop below a certain threshold, even after full depreciation.

Example: "100" if the asset should not depreciate below $100.

Click on

to save the new depreciation rule.

to save the new depreciation rule.

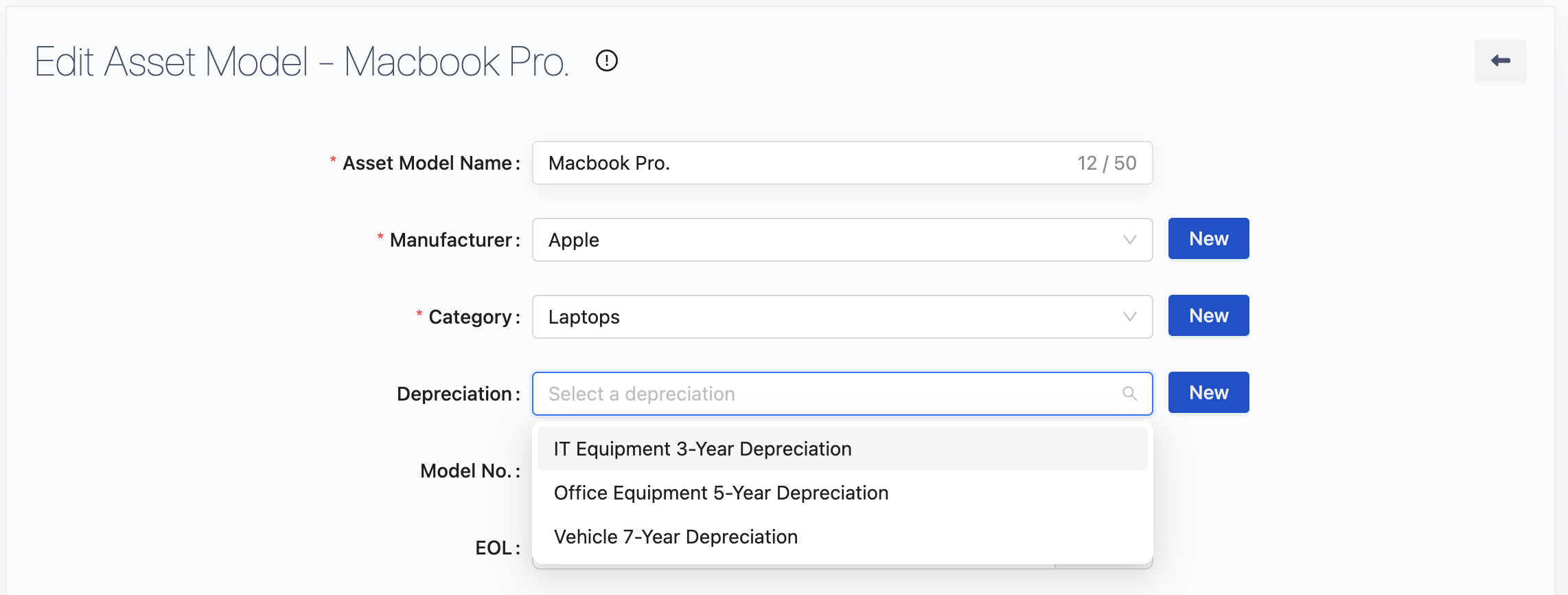

Assigning Depreciation to Asset Models

Once a depreciation rule is established, it can be linked to asset models. By assigning a depreciation rule to an asset model, all assets within that model will undergo depreciation calculations based on the rule.

The procedure involves:

Create Depreciation: Follow the steps outlined above to create a new depreciation rule.

Assign the Depreciation to Asset Models: Navigate to the Asset Models tab on the sidebar menu, then assign the created depreciation rule to the relevant asset models.

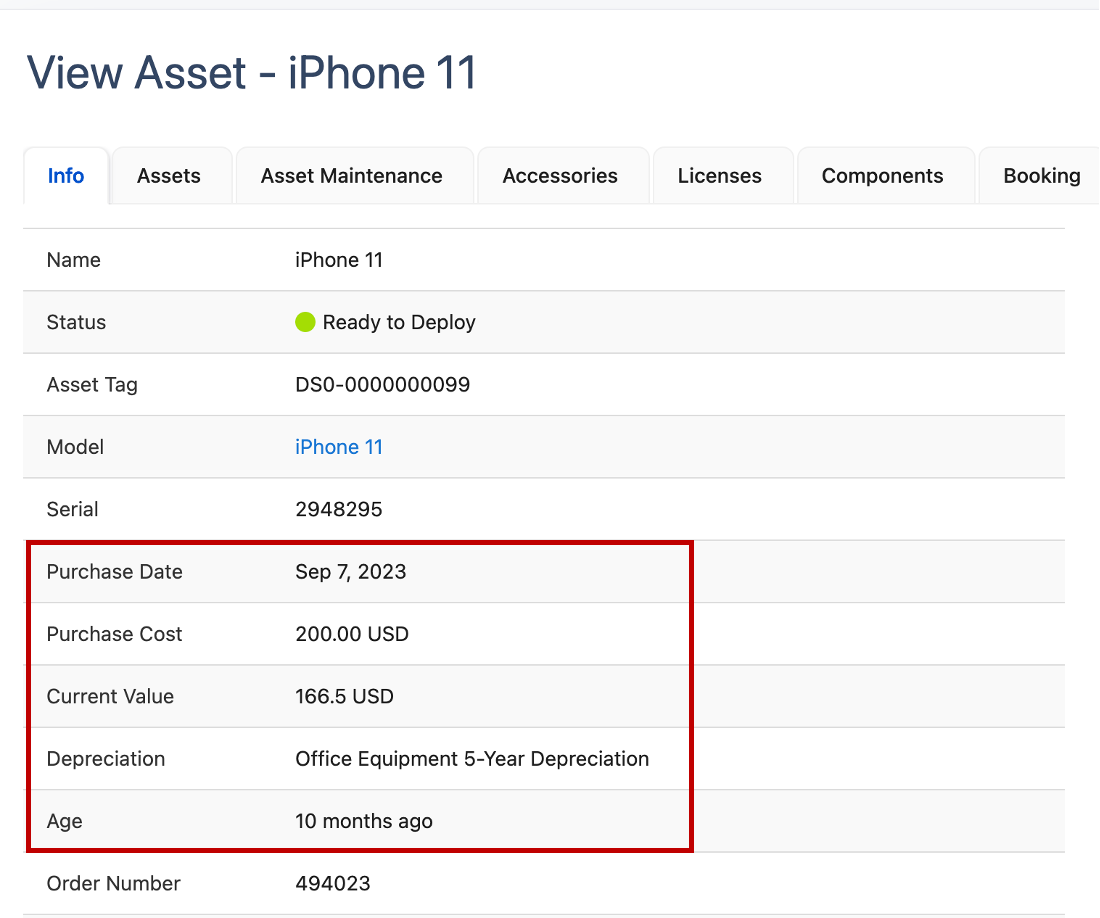

Assets Depreciation Calculation: All assets under the assigned asset models will have their depreciation calculated automatically.

Depreciation Calculation

The calculation of depreciation in AssetIT is based on the straight-line depreciation method:

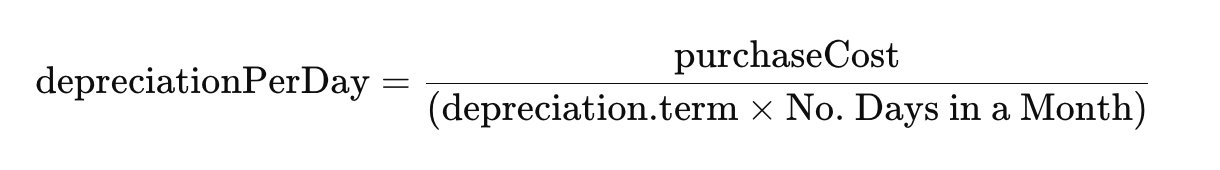

Depreciation Per Day:

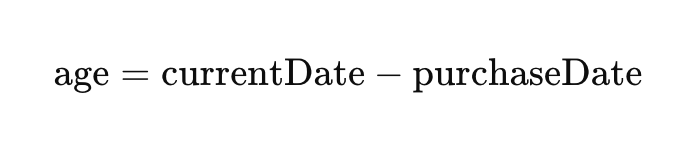

Asset Age:

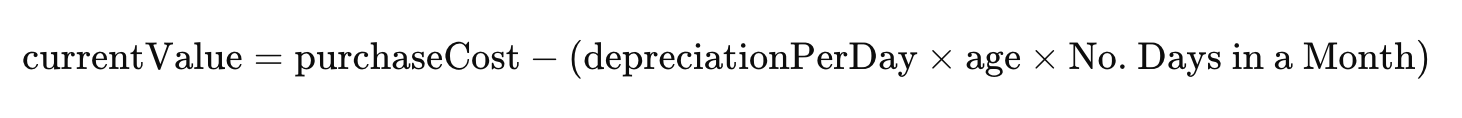

Current Value:

Despite the calculations, if the current value falls below the minimum value threshold, AssetIT will display the minimum value instead.

By following these calculations, AssetIT ensures that the depreciation is accurately tracked for all assets, providing a clear view of their current value over time.

.png)